Raspberry Pi mulling UK listing in boost to London market

The UK computer firm has hired advisers ahead of a possible float.

Your support helps us to tell the story

This election is still a dead heat, according to most polls. In a fight with such wafer-thin margins, we need reporters on the ground talking to the people Trump and Harris are courting. Your support allows us to keep sending journalists to the story.

The Independent is trusted by 27 million Americans from across the entire political spectrum every month. Unlike many other quality news outlets, we choose not to lock you out of our reporting and analysis with paywalls. But quality journalism must still be paid for.

Help us keep bring these critical stories to light. Your support makes all the difference.

UK computer firm Raspberry Pi has confirmed plans to list on the London stock market in a move that could value the firm at a reported £500 million.

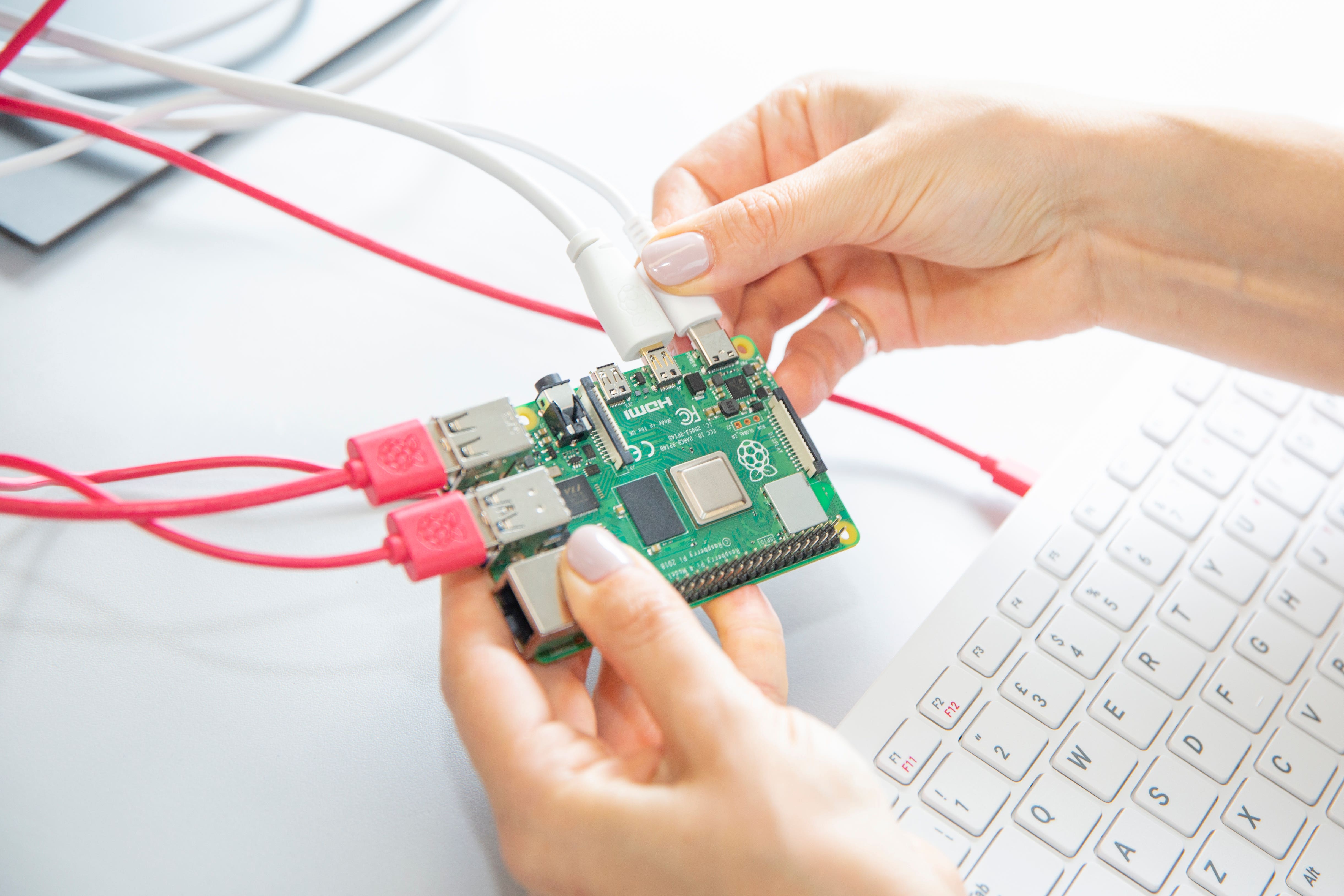

Cambridge-based Raspberry Pi – known for affordable credit card-sized computers designed to boost coding skills among children – has said it is considering an initial public offering (IPO) on the London Stock Exchange’s main market.

It has hired advisers Peel Hunt and Jefferies ahead of a possible float and plans to publish a registration document.

If the IPO goes ahead, it would be a boost to London’s flagging stock market, which has been hit by a swathe of UK-listed firms being bought out or defecting abroad.

Paddy Power owner Flutter has moved its main stock market listing to New York, while German-owned Tui approved a plan to delist from London in February and in another blow, UK chip maker Arm Holdings chose Wall Street over London for its stock market return.

Raspberry Pi was founded by computer scientist Eben Upton in 2008, before releasing its first product in 2012.

In an ever-more-connected world, the market for Raspberry Pi’s high-performance, low-cost computing platforms continues to expand.

It has since sold more than 60 million of its single board computers alone.

The group’s products are sold across more than 70 countries worldwide.

Mr Upton, founder and chief executive of Raspberry Pi, said: “Raspberry Pi enthusiasts will see the next phase of our development offer unprecedented opportunities for creativity and innovation.

“Our commitment to low-cost computing, a fundamental part of what is special about Raspberry Pi, is unchanged.

“In an ever-more-connected world, the market for Raspberry Pi’s high-performance, low-cost computing platforms continues to expand.

“We have the technology roadmap to play an increasingly significant role, and we are excited to embark on the next stage of our growth.”

The group is a subsidiary of the Raspberry Pi Foundation – a UK charity founded when the company was set up in 2008, with the goal of promoting interest in computer science among young people.

As a major shareholder in Raspberry Pi, the foundation has received around 50 million US dollars (£39.7 million) in dividends since 2013, which has been used to advance its educational mission globally, according to the group.

Mr Upton said: “For the Raspberry Pi Foundation, a patient and supportive shareholder, this IPO brings the opportunity to double down on their outstanding work to enable young people to realise their potential through the power of computing.

“We’ve hugely appreciated their support on our journey so far and are delighted that the Foundation will remain a major shareholder.”

Raspberry Pi reported revenues of 265.8 million US dollars (£211.1 million) in 2023, with operating profits of 37.5 million US dollars (£29.8 million).

The firm said that, on listing, it expects to receive the London Stock Exchange’s Green Economy Mark, which identifies companies and funds that derive 50% or more of revenues from products and services that contribute to the global green economy.