The Courage to Act: A Memoir of a Crisis and its Aftermath by Ben Bernanke, book review: Man in charge of the meltdown

Bernanke reveals how he dealt first with the financial crash and then with the economic recession that followed

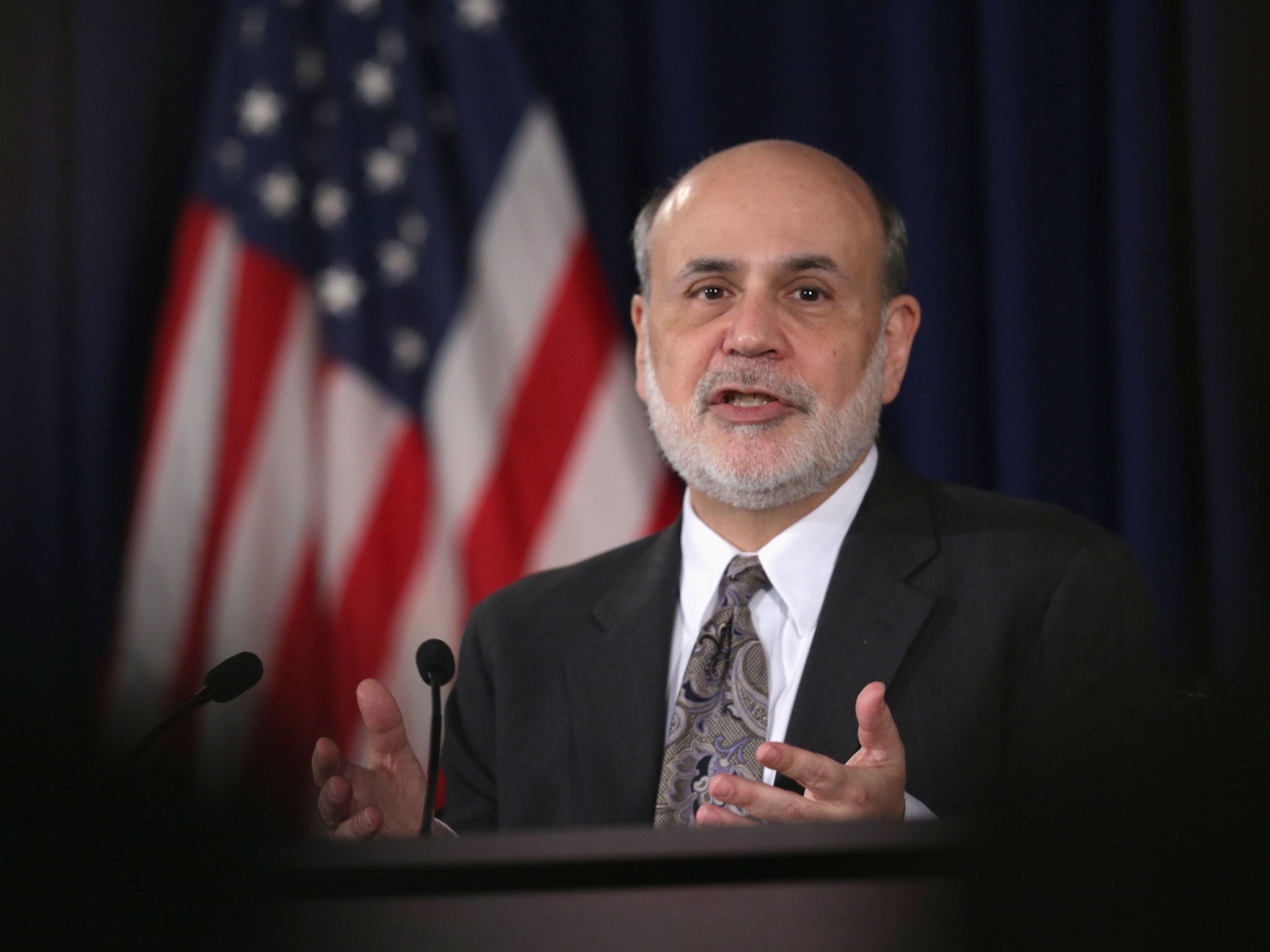

"Why", asked the Queen during her visit to the London School of Economics in November 2008, "did no one see it coming?" The most thorough and persuasive explanation yet comes in a book by one of the key people, arguably the key person, involved, Ben Bernanke, chair of the US Federal Reserve Board.

The title may sound over the top, but he came into office just before the crisis, and had to cope with it and its aftermath. That the US economy has scrambled through is in large measure thanks to the policies the Fed and two successive administrations developed.

Why did they not see it coming? Well, quite a lot of them did see warning signs, but could not quite believe how bad the crisis would be. They could not believe that US house prices would crash and that this could undermine the entire financial system. This "sub-prime" lending boom, then bust, was the trigger for the subsequent collapse. The big question, relevant here too, is whether this was a failure of monetary policy or of regulatory policy.

Some argue that had central banks increased interest rates more sharply they could have trimmed the top off the boom and hence reduced the scale of the bust. Bernanke, who was then a new member of the Federal Reserve Board, not its chair, argues that it was principally a regulatory failure. Responsibility was split among many bodies, whose actions were often blocked by politicians under pressure from lobby groups.

"The result," he writes, "was a muddle." Indeed. Where his story becomes most gripping is when he has to cope first with the financial crash and then with the economic recession that followed.

We remember the collapse of Lehman Brothers as the key moment in the crash, with some arguing that the failure to support it made matters much worse. What we tend to forget is that this was just one event in a long drawn-out saga. Bernanke defends the failure to save Lehman, the night he and Tim Geithner, the Treasury Secretary, tried and failed to find a buyer.

"It was," he writes, "a terrible, almost surreal, moment. We were staring into the abyss. I pressed Tim for an alternative solution, but he had none. 'All we can do,' said Tim in a classic Geithner-ism, 'is put foam on the runway.'"

The great recession followed. The Fed did what text-book central bankers do in such a crisis: they pumped money into the system. Governments did what they classically do: they ran bigger fiscal deficits, though the US Congress proved an awkward barrier. The US managed the strongest recovery of the large developed nations, and though the UK has done almost as well, it is clear when seen through American eyes, it was a marginal player. Gordon Brown gets a one-line reference.

A central banker who was involved in managing the crisis told me, "We didn't do it well, but we did it just well enough." That is not a bad assessment of Bernanke's role, and we should be most grateful for this honest account of it. Maybe courage is the right word after all.

WW Norton, £22.99. Order at £19.99 inc. p&p from the Independent Bookshop

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments