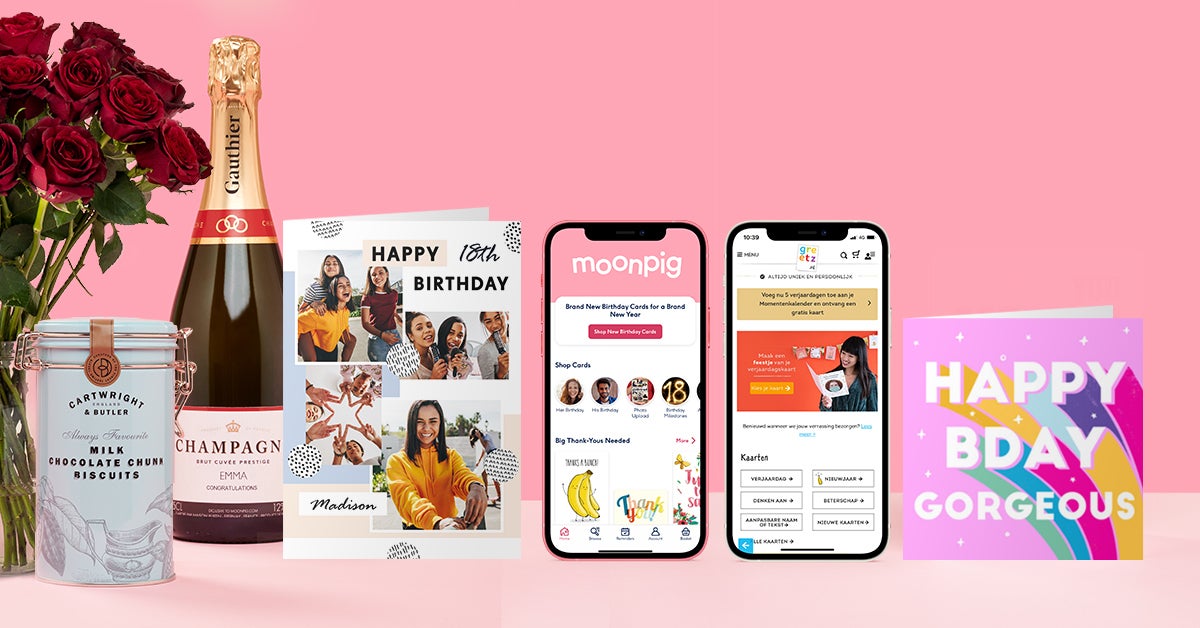

Moonpig snaps up gift experience firm Buyagift for £124m

Shares in Moonpig leapt higher in early trading as investors appeared to welcome the move.

Moonpig Group has announced a £124 million takeover deal for gift experience firm Buyagift.

Shares in the company leapt higher in early trading as investors appeared to welcome the move.

The online greetings card specialist said the move to buy Buyagift’s parent business Smartbox Group UK, which also owns fellow brand Red Letter Days, will help accelerate its growth strategy.

Nickyl Raithatha, chief executive of Moonpig, said the company has “significant potential” for cross-selling between Buyagift and Moonpig.

We see significant potential for the cross-selling of gifting experiences to Moonpig Group's loyal customers.

Buyagift has a base of 3.3 million customers but Moonpig said it will be able to grow this by incorporating it further within its own customer audience.

Moonpig told shareholders that it expects to accelerate Buyagift’s revenues for the current year as a result.

In the latest financial year, Buyagift reported unaudited revenues of £44 million and earnings before tax and interest of £14 million.

The deal is expected to complete by the end of July this year.

Mr Raithatha said: “There is strong strategic rationale for the transaction, and compelling financial benefits.

“Buyagift is profitable and highly cash generative, with a proven track record of strong growth and we are excited by the ways that we can further transform the business using the group’s proven playbook.

“We see significant potential for the cross-selling of gifting experiences to Moonpig Group’s loyal customers.

“We look forward to working with the Buyagift team to deliver an enhanced proposition for our customers and to create value for our shareholders.”

Moonpig held firm on its existing profit targets for the current financial year and said it expects annual revenues to increase to £350 million.

Shares in the company climbed by 11.7% to 262.5p in early trading.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.