How will we pay for the coronavirus debt – and should we?

Eventually we will have to find the money to cover the government’s unprecedented spending and borrowing during the pandemic. But how? Tax expert John Cullinane explains

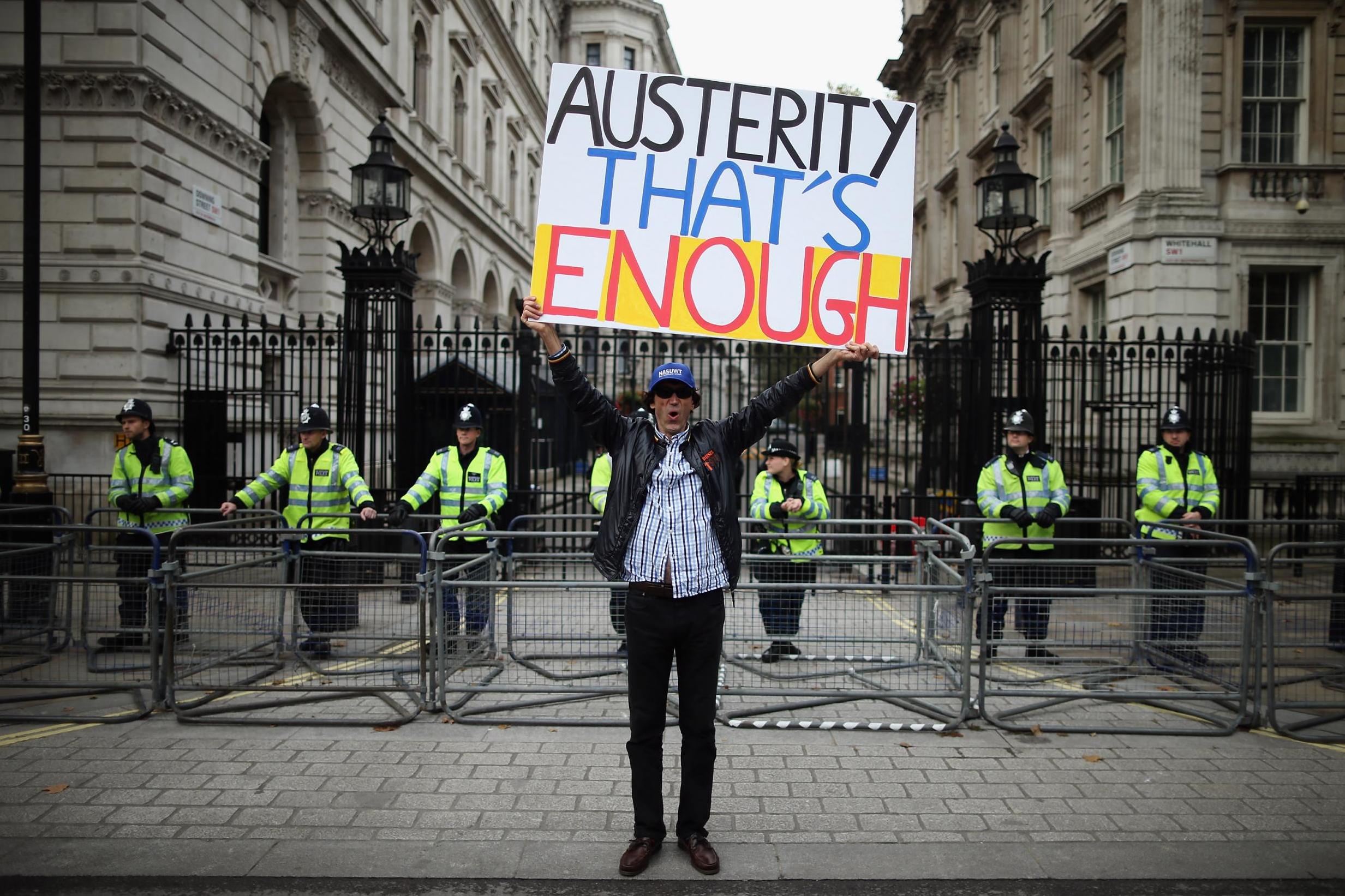

This year’s government budget deficit will exceed £300bn, more than twice the peak recorded after the 2008 financial crisis. It has already taken government debt to more than 100 per cent of GDP, a level portrayed as apocalyptic in the somewhat fevered debates that led to "austerity" in 2010.

How will we ever pay this back? What will have to happen to taxes? History suggests that there are many ways to skin this cat. At the end of the Napoleonic Wars, the UK’s national debt stood at about 200 per cent of GDP. It was paid off with Victorian conventionality. The government raised little in tax by modern standards, but spent even less. Income tax was low and flat rate, and customs duties remained a major, and regressive, source of revenue.

Other than giving themselves time, governments didn’t make things easy for themselves. Interest rates fluctuated, but were generally much higher than now, adding to the cost of the debt. Inflation was virtually non-existent, so the real value of the debt did not diminish by stealth. Wealthy bond-holders made good returns, while the government spent more on servicing debt than on education.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies