Consumer rights: Bling cover dilemma for broke graduate

What to look for when insuring jewellery on a home-contents policy / Another reader stung by unfair bank charges / Advantages of buying over the internet

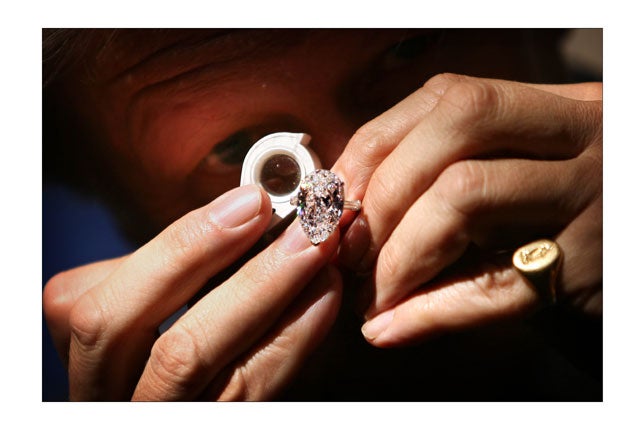

I have just moved into a flat with a friend. We're graduates and haven't got jobs yet. I've got quite a lot of jewellery and my mother wants me to have it insured but I'm not sure how much to insure it for and I can't afford to spend much on a policy.

HM

Kent

Your jewellery can be insured under your contents policy. You can get stand-alone jewellery policies but those are usually needed only if something is particularly expensive. Think carefully about what you want the insurance to do. Are you insuring your jewellery in case someone breaks into your flat and steals it? Do you wear it often and would you need your insurance to cover you outside your flat? Do you have pieces that are very valuable? Would you want to be able to replace anything that goes missing with new items? If it has more sentimental value than monetary value, replacing it with new items won't really help you to get over its loss.

Most insurers ask you to tell them if you have items that are worth more than a certain amount – usually about £1,500 to £2,000. If you don't know how much individual pieces are worth, it would be a good idea to take it all to a jeweller to get it valued. Take photos of it too in case you need them for the insurer or to make a claim. If you're going to be travelling, either have the jewellery insured for anywhere in the world or leave it at home.

Contents insurance covers all the contents of your flat, so you need to be sure that you don't underestimate how much your property is worth. If you've been furnishing the place with second-hand stuff from charity shops, the bill isn't likely to be too big. But if you've also got antiques from your grandmother or nice rugs from generous parents you need to add those into the valuation too. Recently, price comparison website Confused.com found that the average family of four estimated that their valuables were worth £25,000 when in fact they were worth £55,000.

How much your insurance costs also depends on where you live. Some areas will be seen to be riskier than others as far as the insurance company is concerned; more at risk of flood, more likely to be broken into. You can do several things to keep the bill down such as fitting better locks, an alarm, or window locks, and keeping your jewellery in a locked safe. All of these cost money.

If you want to keep your insurance bill down until you get a job, take your jewellery home to your parents and ask them to make sure it's covered under their contents policy – for all risks, anywhere in the world – and borrow a few different pieces each time you go home.

***

I've just had a letter from my bank telling me that because I was £17.50 overdrawn for one day last month they're taking two separate charges – one for £35 and one for £28 – out of my account to cover their costs. I've never been overdrawn in my life and it was because I bought something for £25 from a shop on my debit card and the amount was taken out of my account straight away. Is there anything I can do? It seems ridiculous to end up paying £88 for something that should have cost £25.

JS

London

You've gone overdrawn without agreeing an overdraft facility with your bank. The charges for unauthorised overdrafts have been high and there have been thousands of bank customers demanding refunds over the past couple of years. There is a Supreme Court decision to come on Wednesday on whether these charges come under the Unfair Terms in Consumer Contract Regulations. If the banks lose this case, then the Office of Fair Trading will be free to decide whether or not bank charges, such as yours, are justified. In the meantime, some banks have cut or dropped their charges while others are carrying on business as usual.

It could be a long time before this is sorted out. I would advise you to talk to your bank, point out that you've never been overdrawn before, that you were actually only overdrawn for a matter of a few hours and ask them to refund or reduce the charges. Think about changing your bank in protest and set up an arrangement where, if you're in danger of being briefly overdrawn, you either have an authorised overdraft on which any charges are lower or the bank automatically moves money from a savings account into your current account. It used to be three days before anything you'd spend on a debit card got taken from your account. Now, in some cases, it's virtually instantaneous, so beware.

***

I've finally got to grips with the internet and am doing all my Christmas shopping that way this year. Am I right in thinking that if I order something and don't want it when it arrives I can send it back and get my money back?

PG

Devon

You have the same rights when you buy over the internet as you do when you buy from shops but with the added protection that you have seven days to change your mind. So everything you buy should be as it was described, fit for the purpose that it claims to be fit for and shouldn't be faulty. And because you are buying over the internet you're covered by the Distance Selling Regulations which cover goods and services bought by internet, phone, digital TV or mail order.

You have the right to clear information about the goods and services before you decide to buy; you should be given that information in writing and you have seven working days in which to cancel the contract. If you're buying a service you can cancel it up to seven working days after the order was made; if you're buying goods you can cancel up to seven working days after the goods have arrived. You have to let the trader know in writing – which could be by email – that you're cancelling your order. And there are things that you can't cancel such as food or flowers or audio or video recordings or computer software once you've opened the packaging, or something you've had made to your own specifications. You should get your money back as soon as possible but certainly within 30 days.

Do you need a financial makeover?

Write to Julian Knight at the Independent on Sunday, 2 Derry Street, London W8 5HF j.knight@independent.co.uk

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies