Derek Pain: Eurocrats aiming to tear up paper share certificates

No Pain, No Gain

Paper share certificates are under threat yet again. After valiantly fighting off determined attempts to enforce their abolition in earlier years of this century, traditionalists are now confronted by the busybodies of Brussels.

The European Union, so prone to interfering in many aspects of our lives, is, it seems, planning to kill off the issue of certificates by 2015 and wipe out existing ones by 2020.

I was one of those who fought against the earlier attempts to end the age-old method of proof of share ownership as various City organisations attempted to foist their desire for computerised registration on unwilling shareholders. Eventually, the Government, at one time supportive of what is bureaucratically called “dematerialisation”, called a halt to the proceedings.

But my guess is that Westminster will not lift a finger to block this EU initiative. Our MPs seem quite happy to accept a succession of new Brussels directives, irrespective of damage and inconvenience inflicted. And make no mistake the ending of share certificates will cause considerable distress.

In the past the abolitionists envisaged an electronic bank-like statement replacing the dear old certificate. Just how the eurocrats intend to cement a deeply unpopular measure remains to be seen. There is talk of staying on a company's share register and avoiding the Crest electronic system.

Just why certificates should be abolished is a mystery. I suppose it is indicative of the change-for-change sake mentality of so many politicians. After all, those of us who want to stick with paper have to pay for the privilege. And the cash we have to fork out must ensure that providers are richly reward. So nobody is inconvenienced.

Many small shareholders are happy with paper. They do not subscribe to the view that everything should be electronic. Judging by computer malfunctions and frauds that come to light, there must be every chance that online certification will be subjected to such disasters.

Then there is the position of those without computers. It is reckoned that 5.1 million pensioners have never bothered to go online. Add on the middle-aged and even younger elements of society who are not computerised and it becomes clear that a sizeable section of the population has eschewed the attractions of the internet. I suggest that many of the 5.1 million pensioners are likely to be small shareholders; don't forget they are of the age that dealt with Margaret Thatcher's privatisations.

Major shareholders – and nimble-footed private ones – are already on line. What I object to is the lack of choice. The right to hold paper and pay for the privilege is likely, at the whim of bureaucrats, to be abolished. It will create unnecessary havoc among many small shareholders, mostly elderly, who could be cut off from their investments.

Indeed, non-computerised shareholders are already suffering. Some companies only send them printed annual reports, which they have to request. Dividends could arrive twice a year. All other communications are online. Another point; many internet users are under stockbroker nominee accounts and are not actually on a company's register. They cannot, therefore, attend meetings, vote, or accept any perks and receive dividends directly.

As I said on this subject seven years ago, when statistics of the day indicated that as many as 9 million shareholders were still with paper, it is “surely more sensible and simple to keep electronic and paper systems operating in tandem”. But sensibility suffers in the relentless pursuit of change which has developed as a myopic obsession in Brussels. I would welcome a far-reaching UK disengagement from the EU. Such a move would be beneficial, both economically and politically.

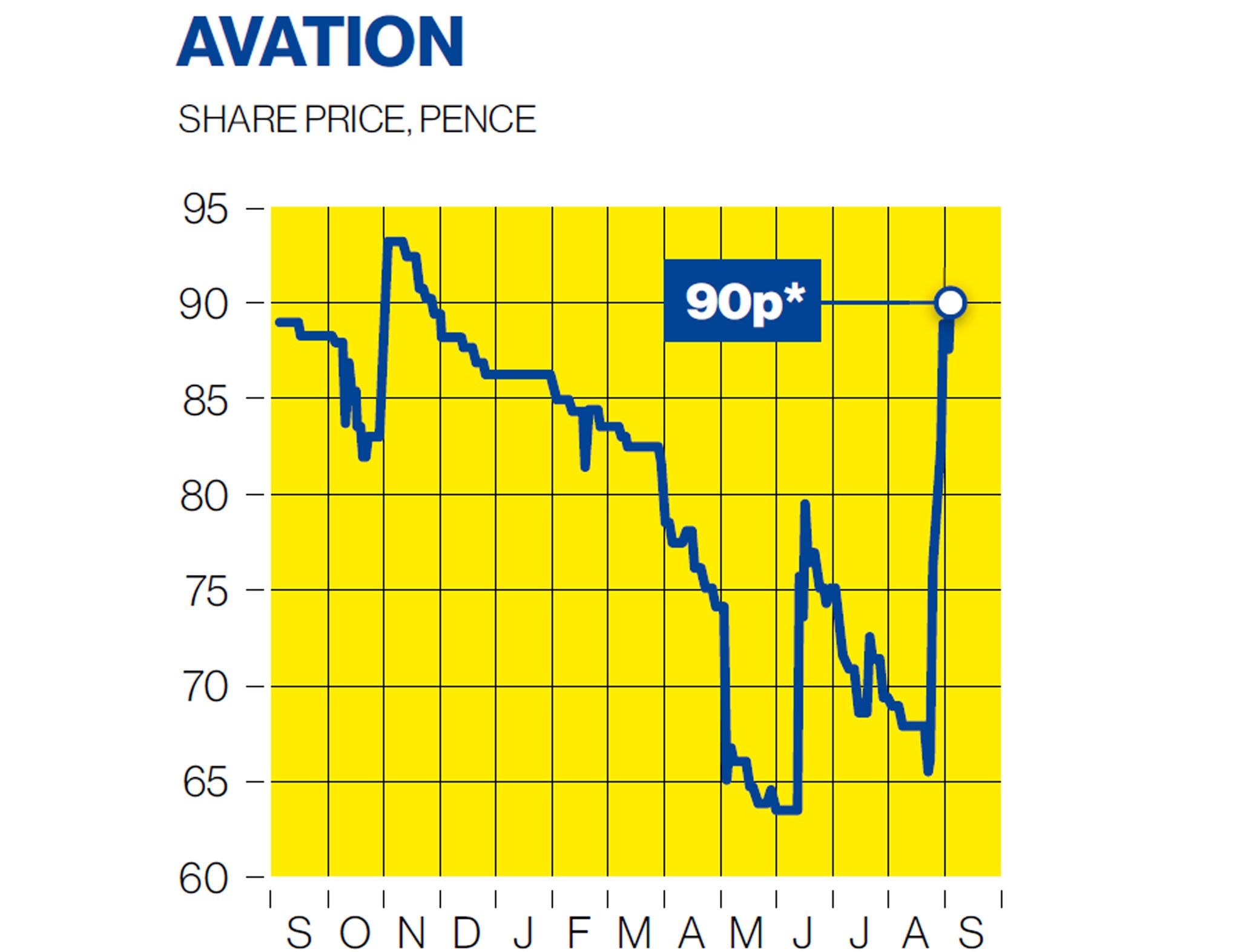

Finally, I am delighted that one of the no pain, no gain portfolio's laggards has this week exceeded the buying price. More about Avation next week. But in the meantime it is worth recording that the aircraft- leasing group has flown in with better-than-expected profits and a dividend increase.

Prospects are encouraging and two directors have purchased stock.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies