Hamish McRae: Events have overtaken inflation targets

Economic View

Sometimes things change with a bang; more often they creep up on you. The change in global monetary management that is taking place now is the second sort.

When sterling came off the gold standard in 1931 it was clear something very big had happened. When the Bretton Woods fixed exchange rate system broke up during 1972 and the world moved to floating rates we were aware that a big change had begun, though the abandoning of the peg was a progressive movement taken by different countries at different times. And at the time hardly anyone saw the catastrophic surge in inflation that would be associated with the break-up.

The return to monetary discipline during the latter 1970s and early 1980s was also a progressive movement, as was the switch from money supply targets to inflation targets in the 1990s.

Now we are in the middle of another change, for inflation targets are being downgraded and replaced with the more mushy aim of trying to maintain growth. But because it is a progressive change rather than a big bang, we have hardly begun to think through the consequences.

There has to be some framework for central bankers to make decisions about interest rates, bank capital requirements and so on. Under the Bretton Woods fixed exchange rate system the prime rule was to maintain the currency within 2 percentage points on either side of a central value. Domestic output and inflation were subsidiary objectives beside the one of maintaining the external value of the currency. When there was no objective, as during the 1970s, the central bankers lost control.

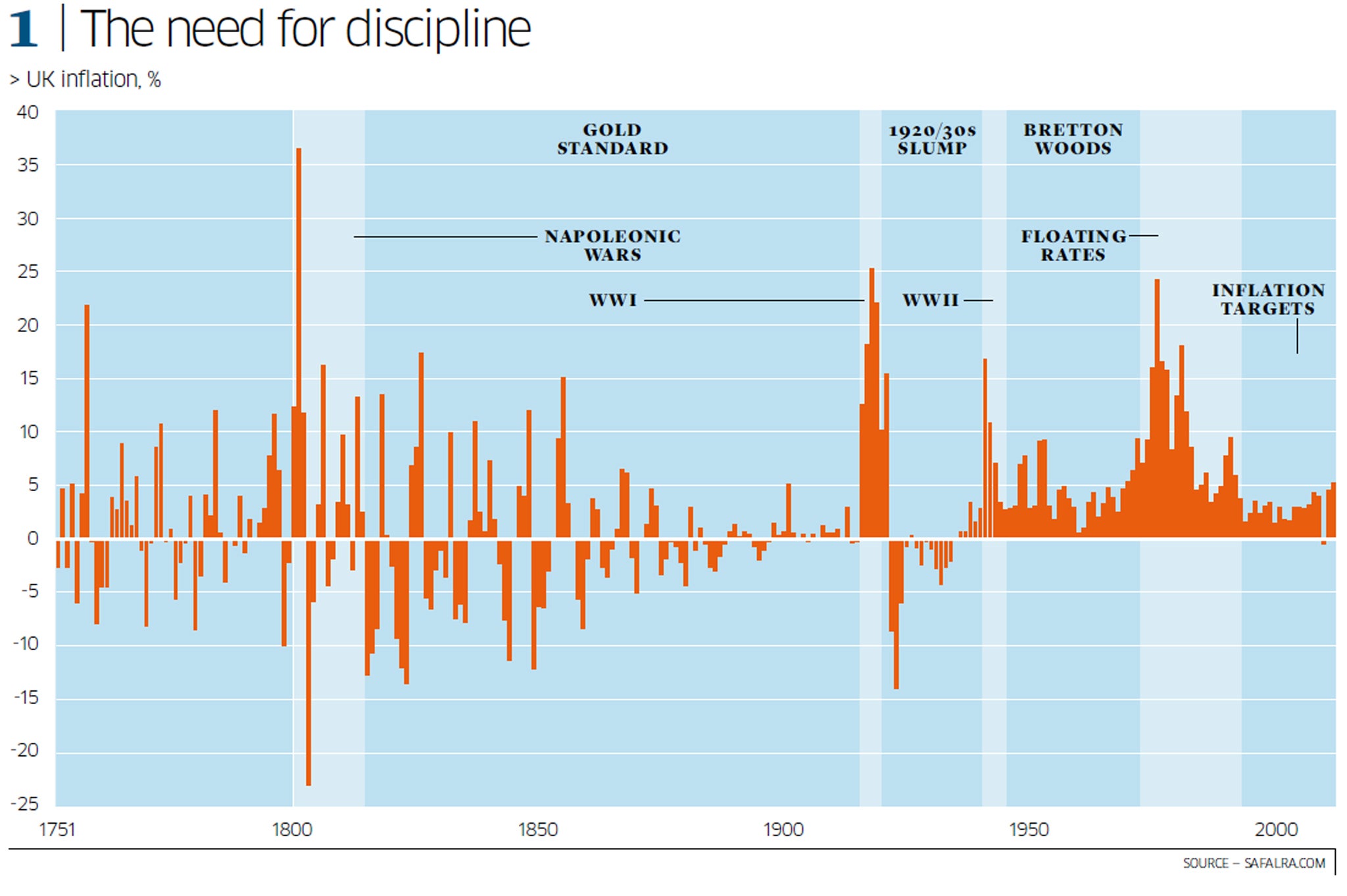

You can catch a feel for this from the chart, which shows inflation in the UK since 1750. The data is from official sources but this is taken from a website called Safalra, which enables people to work out how much you should multiply money at a specific date in the past to see what it is worth today. For example, a pound in 1880 was worth £100 in today's money. More scarily, a pound in 1939 would be worth £55 today.

A few points stand out. One is that the long period of overall price stability between 1820 and 1913, the high years of the gold standard, actually saw big swings in inflation from one year to another. Another is that Bretton Woods did bring reasonable stability in prices, even though that was not an explicit objective. And a third is that the inflation of the 1970s and early 1980s was unprecedented. Peak inflation, in 1975, was 24.2 per cent and in 1980, the first full year of the Thatcher government, it hit 18 per cent. It was not until the early 1990s that inflation came back under reasonable control – I say reasonable because price levels have doubled since then.

So there has to be discipline. The question is what is most appropriate. When the emphasis was switched from money supply targets to inflation targets in the 1990s the argument was that it was better to have a direct target rather than a subsidiary one. Not all central banks adopted an inflation target – the US never formally did so – but the broad aim that inflation should be somewhere around 2 per cent a year became the de facto global standard.

Unfortunately, it proved a false friend. The explosive impact of China entering the global economy, exporting goods at much lower prices than the West could match, put downward pressure on inflation rates in the developed world. Central banks preened themselves at their success in controlling inflation and pumped up the money supply to try and keep inflation up. The result, coupled with deregulation of the banking system, was an asset boom. There was very little inflation in goods and services but huge inflation in assets, particularly property. The inevitable bust resulted.

The response of the central banks to that has been to print money. So far that has not shown through in much inflation at a goods and services level, but we have had a modest recovery in asset prices. House prices in the US are now recovering and in Britain in many places are just about back to their previous peak. Share prices in most of the developed world are close to their previous peak too.

But inflation targets are clearly a discredited tool. No one quite wants to say that, but they have in effect been abandoned in the UK, while in the US the Federal Reserve now regards reducing unemployment as a key objective and will not tighten policy until it comes down further.

Here, we have new guidelines for the Bank of England, which in effect accept that the single target of holding inflation around 2 per cent has been overtaken by events. In Japan they are adopting an inflation target, the aim being to end deflation. So the Bank of Japan is going to spray money around too.

The only major central bank holding out is the European Central Bank. It, too, stoked up an asset boom in peripheral Europe, increasing divergence in the eurozone – so having exactly the opposite of the effect that the advent of the euro was supposed to do. Overall it has achieved its inflationary objectives but at the cost of massive deflation in some areas. But its de jure mandate of holding inflation close to, but below, 2 per cent has been supplanted by a de facto one of preserving the eurozone at almost any cost.

So what the world is doing is to say: "Look, inflation targets have proved an inadequate benchmark for policy and while we don't dare abandon them altogether, we will supplement these with other vague aims, of which the most important will be to boost growth."

Many of us expect this will eventually result in another burst of inflation and we will have to reintroduce monetary discipline. But not yet.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments