The UK Government has hit its 2016-17 public borrowing target, but the deficit in March was greater than expected raising further doubts about the momentum in the economy.

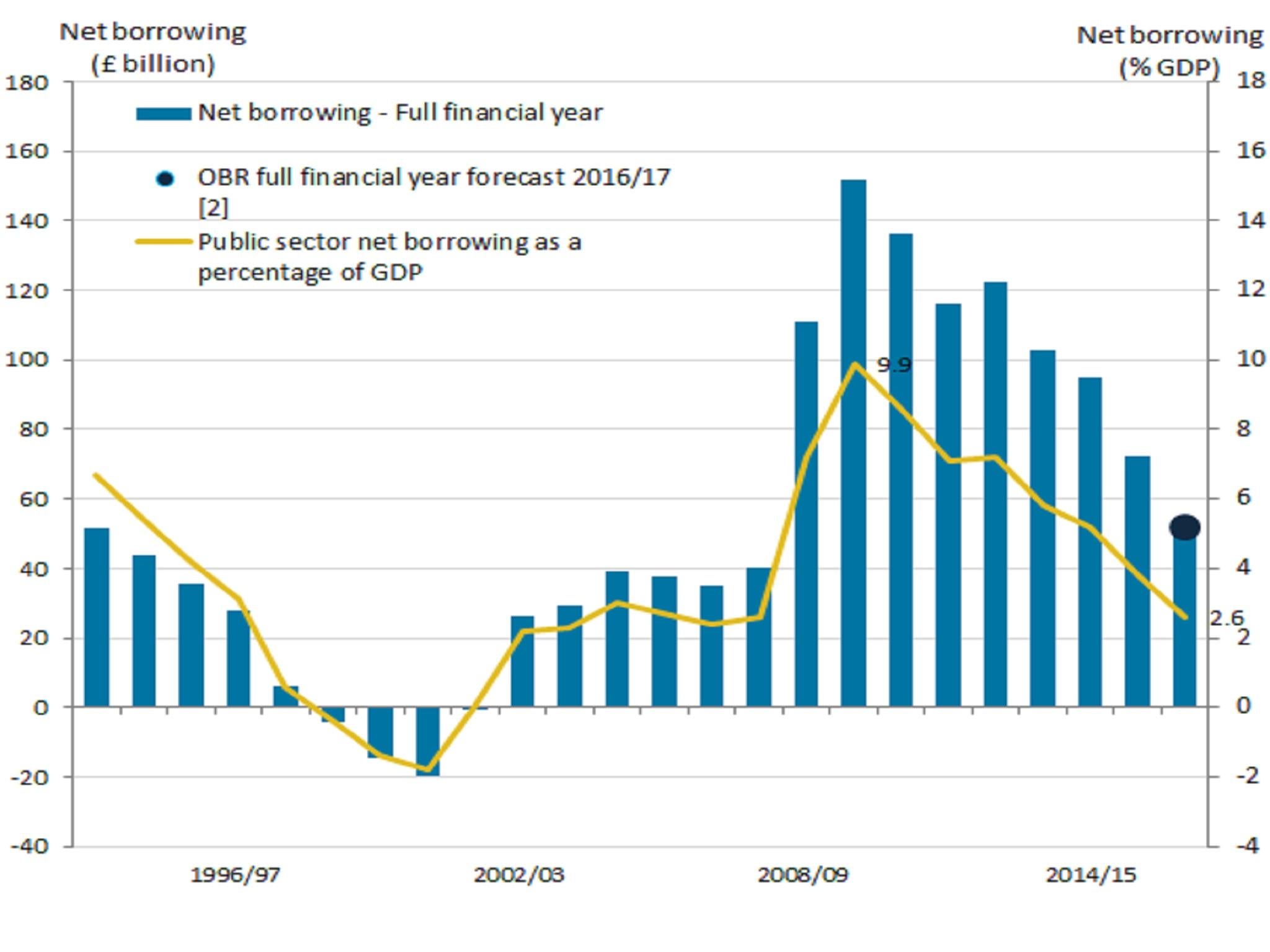

Borrowing for the full financial year came in at £52bn, roughly in line with the £51.7bn forecast of the Office for Budget Responsibility at the time of the March Budget.

According to the Office for National Statistics, that is equivalent to 2.6 per cent of GDP, down from a peak of 10 per cent in 2009-10.

However, the deficit in March was £5.1bn, worse than the £3.2bn City analysts had pencilled in and higher than the £4.3bn of borrowing in the same month of 2016.

And within the release there were some signs of weakness, with VAT receipts up just 0.9 per cent on a year earlier at £10.6bn.

On target

Income tax and capital gains receipts were down 2 per cent at £15.7bn.

Overall tax receipts were up 3.5 per cent on a year earlier, which Samuel Tombs, an economist at Pantheon, noted was below the 6.2 per cent average growth rate seen over the first 11 months of the fiscal year.

“The public finances add to evidence that the economy has slowed significantly this year,” he said.

“Income tax and taxes on production, which reflect the near-term strength of the economy, have been slowing for some time, and they fell by 3.5 per cent and 1.6 per cent year-over-year in March, respectively.”

The 2016-17 deficit has been flattered by several one-off factors.

The OBR has forecast public borrowing to rise again in 2017-18 to £58.3bn before falling in 2018-19 to £40.8bn.

“Fiscal policy is still set to provide a significant drag on GDP growth over the next few years. And we doubt that this stance would be changed significantly in a potential post-election Budget so long as the Conservatives win a majority," said Scott Bowman, economist at Capital Economics.

The ONS reported that public sector net debt as a share of GDP rose to 86.6 per cent in March.

The overall economy grew by 0.7 per cent in the final quarter of 2016, but most analysts expect a sharp growth slowdown in the first quarter of 2017 to between 0.4 and 0.5 per cent due to higher inflation curbing consumer spending.

The preliminary ONS estimate for Q1 GDP will be released on Friday.

Separately, Citigroup's monthly public inflation poll reported Tuesday that expectations of long-term price rises dipped in April to 2.9 per cent, down from 2 per cent in March.

“Declining long-term inflation expectations could be a sign that households detect signs of economic weakness, despite resilient economic data immediately after the EU referendum,” said Christian Schulz of Citigroup.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies