Head of IFS urges Government to spend more on UK infrastructure: 'We remain behind many countries'

'It might have been helpful to be clear that it was on a trajectory to an even higher level because we remain behind many countries in the terms of the quality of our infrastructure and the quantity of investment in it,' said Paul Johnson

The director of the Institute for Fiscal Studies think tank has suggested the Chancellor should be spending more on the UK's infrastructure.

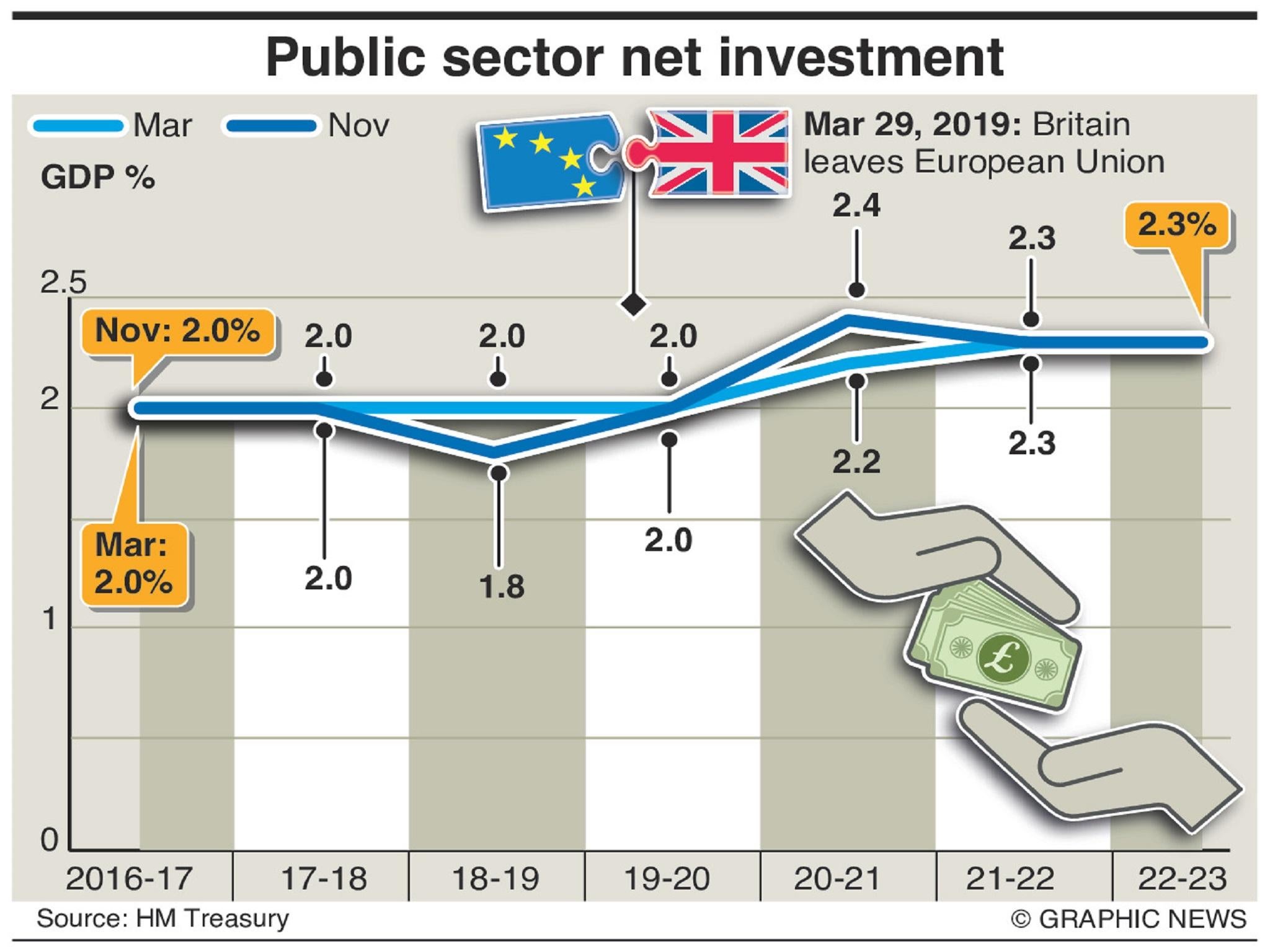

At last week's Budget Philip Hammond announced an increase in capital investment spending on things like rail, roads and broadband networks over the coming years, so that public sector net investment hits 2.4 per cent of GDP in 2020-21, the highest rate since the financial crisis.

Excluding the years between 2009 and 2012, when the previous Labour government deliberately ramped up capital spending to support demand during the recession, this will be the highest rate of state infrastructure investment since the late 1970s.

But Paul Johnson, the director of the IFS, told the Commons Treasury Select Committee on Wednesday that the Government should go still further.

"It might have been helpful to be clear that it was on a trajectory to an even higher level because we remain behind many countries in the terms of the quality of our infrastructure and the quantity of investment in it," he said.

Labour has pledged to put an additional £25bn into annual investment spending, lifting it to 3 per cent of GDP a year.

"You could easily spend 3 per cent, rather than 2.5 per cent of GDP extremely effectively in a way that has a long time positive impact," said Mr Johnson.

However, he cautioned that it was crucial to identify the right projects for investment.

"We spend much too much time asking is the right answer 2.5 or 3 per cent of GDP and nowhere near enough time asking what exactly is the right set of things to spend this on," he said.

"I’m sceptical of the idea that one could ramp [capital spending] up a great deal more quickly. I was in the Treasury in the early 2000s when investment spending was rising and literally the underspends were multiple billions every year because it couldn’t get out of the door and quite a lot of what did get out of the door was not terribly well spent."

The Coalition, following the fiscal consolidation plans pencilled in by the previous Labour Government, slashed capital spending rates drastically in 2010 in order to eradicate the Budget deficit entirely by 2015.

It fell to just 1.7 per cent of GDP in 2013-14.

Labour today proposes to establish a new fiscal rule which excludes capital spending from the Government's balanced budget target, something that many public finance experts, including the IFS, agree would be preferable given well-chosen public investment schemes boost national productivity and tax revenues over the long term.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments