First-time buyers given a push across the threshold

From £1 houses to Help to Buy, Julian Knight looks at the schemes that help people on to the housing ladder

These are heady days for would-be first-time buyers. The property price take-off first seen in the capital is now spreading across the UK. As a result, many people will be asking whether or not it is possible to ever get on the property ladder, even with the greater availability of mortgages through schemes like Help to Buy. However, there are now more options to get a place of your own – even with relatively small deposits of 5 per cent or even in one case just £1 – than there have been since the credit crunch. Here are some unusual ways you or your kids can own their own homes:

Homesteading

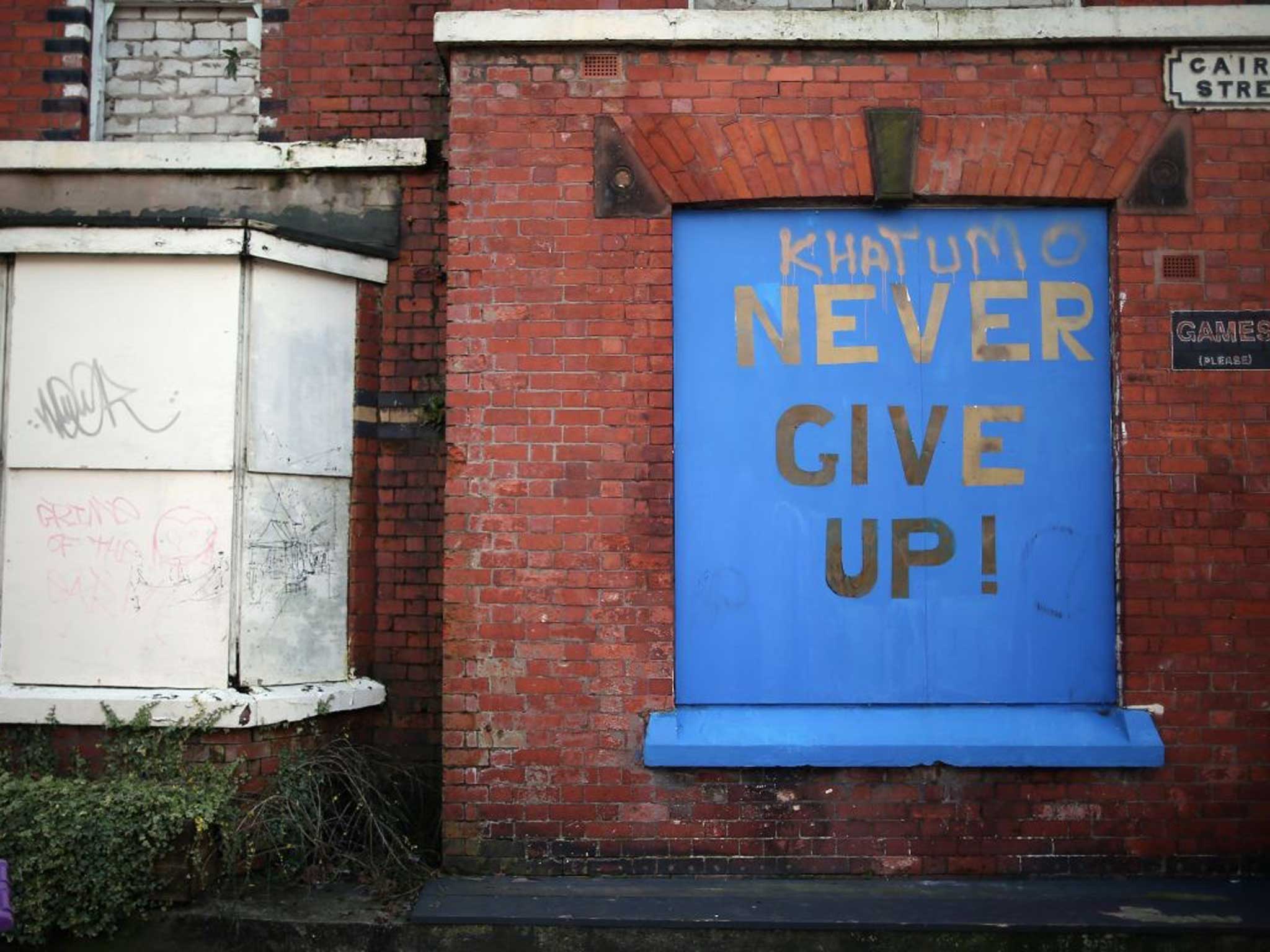

Buy a house for £1, yes £1. Sponsored by the organisation Empty Homes, the idea is to give property away in run-down areas to individuals who promise to renovate and live in them.

Stoke, Liverpool and Newcastle are just three cities which have been pioneering this initiative with striking results.

"We have found that it only takes a handful of owners to move into an area and start investing in property to change the atmosphere from being down-and-out to up-and-coming," says David Ireland OBE, the chief executive of the Empty Homes scheme.

"Many people who choose to homestead have given up any chance of owning their own home, so when releasing new property we are inundated with enquiries," Mr Ireland added.

The transaction isn't complete until the property is made fully habitable. There are loans – through local councils – available for up to £15,000 (www.emptyhomes.com).

Guarantor mortgages

It is easy to see why guarantor mortgages are popular with some lenders. They are able to charge a premium for a loan which is actually secured against the assets of someone – usually a parent – who is in a sound financial position.

"For first-time buyers, having a guarantor can often mean that they are able to get on the property ladder, borrow more than the bank normally would allow and their criteria is often less harsh," Charlotte Nelson from financial information service Moneyfacts.co.uk says.

One of the biggest providers of these loans is Barclays which offers its Springboard product. This, and the similar TSB Lend a Hand mortgage, involve a savings account being opened alongside the home loan which attracts interest but also acts as an asset in case of default. It is normally parents that pay into this savings account and at the end of the mortgage term – say three or five years – the money in the savings account is returned to them.

Buying with a friend or relative

An even bigger step than acting as guarantor is to buy with someone else.

Declan Curran of HomeFix Direct did just that for his first property: "Broadly speaking, it's raising the deposit that presents the obstacle for almost everyone struggling to get on the property ladder; one way of overcoming this is to combine savings with friends and family to raise the required sum together."

However, lenders will want to check out everyone who is taking on the mortgage and that means multiple payslips, bank statements and credit checks. Fall down on any and the deal is kaput. And once the mortgage is secured there are other legalities to take care of. "There are issues of trust and the possibility of disputes down the line so the key is to discuss, list and draw up a legal declaration of trust covering every single possible eventuality, including how any future profits are divided," Mr Curran says.

Shared appreciation

Also called staircasing, the idea is that you use a loan to buy a proportion of a property, renting the remainder. Gradually, over time, more money is borrowed and the percentage owned increases to 100 per cent.

Housing associations are the biggest players in shared appreciation mortgages, but some companies and local authorities offer this type of property purchase.

"Shared ownership is an alternative way for buyers to reach their dream of home ownership in a more affordable way by purchasing a share and paying rent on the remainder – often the combined monthly costs are significantly lower than renting in a similar area," says Kush Rawal, of Thames Valley Housing.

However, on the flip side it can be expensive as fees are incurred every time more of the property is purchased and there is not the usual house price uplift that regular purchasers can expect.

Help to Buy

The government-backed scheme has definitely increased the availability of high loan-to-value mortgages and given a real fillip to market sentiment. However, not all is what it seems in the new Help to Buy market.

There has been no price drop, despite the Government in essence standing as partial loan guarantor. What's more, providers are still asking borrowers to jump through multiple hoops.

"Strict credit criteria can cause difficulty for many," Ms Nelson says. "However, borrowers are wise to shop around as they may find a better deal outside the scheme."

Restricted area mortgages

These are offered by small and medium-sized building societies in very localised areas.

The idea is that the lender knows the market and may even know the individual property as they can literally walk down the road to see it.

These ultra-local loans are supplied by the likes of the Cambridge, Nottingham, Market Harborough and Monmouthshire building societies and rates are competitive compared to the Help to Buy products. They can also have other advantages: "First-time buyers should look closer to home for a mortgage as many local building societies offer great 95 per cent deals but to local residents only," Ms Nelson says.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies